Do not report on Schedule C a achieve or loss from your disposition of house that is neither stock in trade nor held primarily for sale to buyers. as an alternative, you must report these gains and losses on other kinds. To find out more, see chapter three.

a fantastic tax preparer can assure you receive each of the credits you qualify for and will help you keep away from filing an extension or amendment, or having to pay penalties and fascination.

A statutory worker provides a checkmark in box 13 of their sort W-2, Wage and Tax assertion. Statutory staff use agenda C to report their wages and charges.

Only businesses that are owned and operated by spouses as co-entrepreneurs (instead of inside the name of the condition legislation entity) qualify to the election. So, a company owned and operated by spouses by means of an LLC isn't going to qualify to the election of a QJV.

If you do not know final year’s AGI, Possess a duplicate of your respective prior 12 months tax return, you could find that facts by signing into your online account. This is the speediest and simplest way to look at your prior yr adjusted gross income (AGI) and obtain your tax records.

The IRS-Licensed volunteers who present tax counseling are sometimes retired people related to non-gain companies that obtain grants from the IRS.

Excess organization loss limitation. Your reduction from a trade or small business might be limited. Use variety 461 to determine the amount of your extra business enterprise loss, if any. Your excessive organization reduction might be incorporated as income on line 8p of Schedule one (variety 1040) and dealt with as a Web functioning decline (NOL) that you just ought to have ahead and deduct in the subsequent tax year.To learn more about the excess enterprise decline limitation, see sort 461 and its Recommendations.

All of the following credits are Section of the final enterprise credit. the shape you utilize to determine Every single credit is proven in parentheses. additionally, you will have to accomplish sort 3800.

This credit click here score applies for wages compensated to qualifying workers though They're on household and health-related depart, topic to specific problems. To find out more, see type 8994.

The thoughts expressed would be the author’s on your own and possess not been furnished, approved, or normally endorsed by our associates. Ellen Chang Contributor

That’s suitable. If a thief data files a fraudulent return using your tax facts and pilfers your refund, you’ll must hold out a mean of 675 times to obtain the dollars rightfully owed for you, according to the Taxpayer Advocate Service, a gaggle in the Internal income services that works on behalf of taxpayers.

Form W-4, personnel's Withholding Allowance certification, is accomplished by Every personnel so the proper federal income tax might be withheld from their pay.

You are actually subscribed to our newsletters. in the event you can’t obtain any electronic mail from our side, be sure to Examine the spam folder.

video clip meetings by means of Zoom and Team really are a “fantastic different” presently given that in-individual conferences aren’t often achievable, Dula says.

Luke Perry Then & Now!

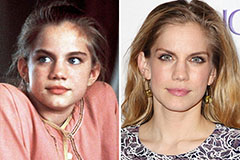

Luke Perry Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Richard "Little Hercules" Sandrak Then & Now!

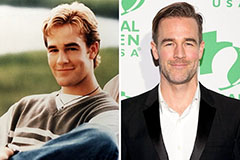

Richard "Little Hercules" Sandrak Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!